SPAC: Special purpose acquisition companies

What is a SPAC?

A company that raises money through an IPO to acquire an existing company, with two years to do so.

Sounds simple and easy, right?.

Well, not really, as IPO investors have no idea what company they will be investing in

and whether the acquisition will even be successful or not. After an acquisition, a SPAC gets listed on the stock exchange.

The year of the SPAC

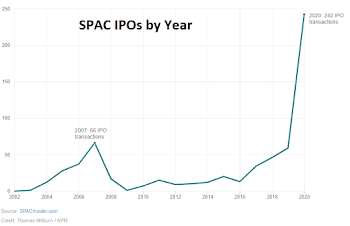

SPAC is not a new phenomenon, it already

existed in the market but came into

the spotlight in the year 2019-20.

Their IPO also hit a record $13.6 billion in 2019, 4 times that of 2016.

Many high profile deals were also carried out during this period.

These include:

The largest-ever SPAC by Pershing Square Tontine

Holdings raised $4 billion.

The merger between Momentus and Stable Road Acquisition Corp, and others.

The pros:

1)Companies can go public much faster.

2)Helps companies raise IPO’s during high market volatility and instability.

3)Selling to SPAC can help add more money to the selling price when compared to a regular IPO.

The reality:

1)Since 2015, 313 SPAC IPOs have been launched and only 93 have completed mergers.

2)Shares from these IPOs deliver an average loss of -9.6% and a return of -29.1%, compared to

the return of 47.1% from traditional IPO.

3)When SPACs fail to complete a merger, even though the fees are refunded, the capital was still locked up for 2 years with 0 profit.

The irony here is that a successful merger delivers loss, whereas a failed one does not.

4)Hidden fees are waiting for you at every junction.

The Conclusion?

The undeniable truth is;

SPACs do produce a great deal of profit, but are terrible for investors as they often lose money in SPAC.

Some SPACs were successful and earned their investors a lot of money, but so did most of

the IPOs.

Comments

Post a Comment